Deal highlights

Compound is the easy way to build your real estate collection. Our team identifies and manages beautiful condominiums in the world's best cities so that you don't have to deal with ownership hassles or headaches.

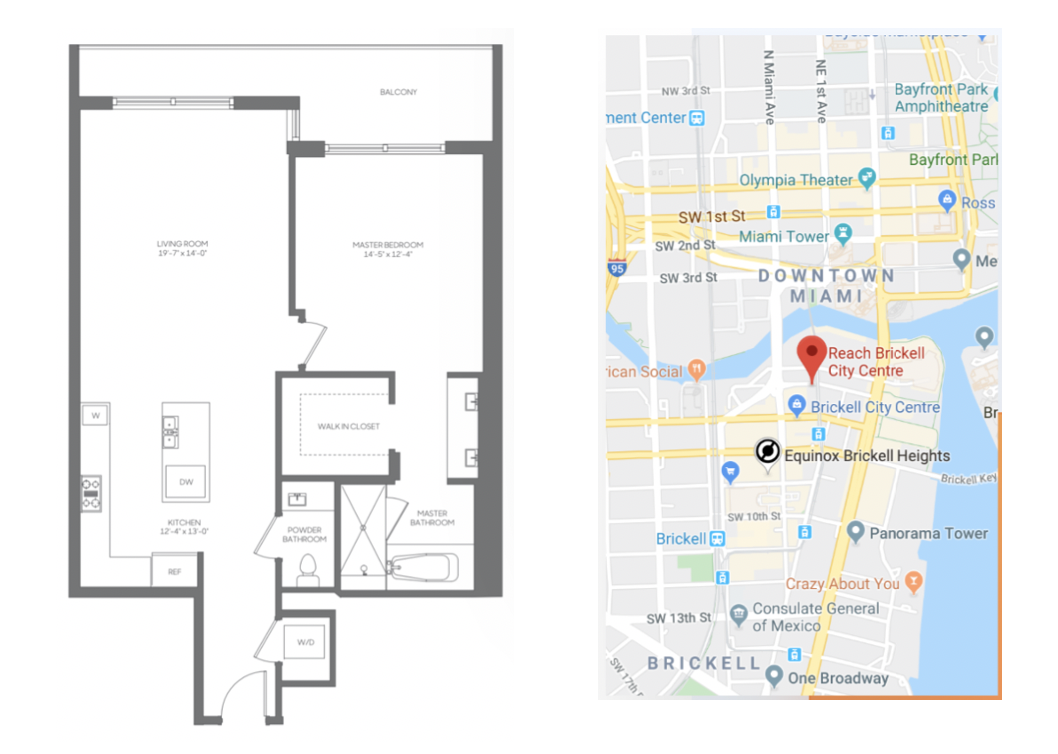

- Miami Condominium Investment – We are offering shares in a 1-bedroom, 1.5 bathroom condominium unit in the Reach at Brickell City Centre, a 43-story residential condominium building located in the heart of the Brickell neighborhood of Miami. The condominium will be rented to generate income for investors until the sale of the unit.

- Equity Ownership – Compound has "sliced" the property into 100,000 equity shares. Investors make a return in two ways: (1) receiving a piece of rental income which we intend to distribute bi-annually and (2) receiving a piece of the income from the sale of the property in the future.

- Brickell City Centre – The Reach condominium is located within a new world-class shopping, food, and entertainment complex.

- Amazing Amenities – Tropical gardens, barbecue grills, heated pools, hot tubs, fitness center, library, and full-service spa.

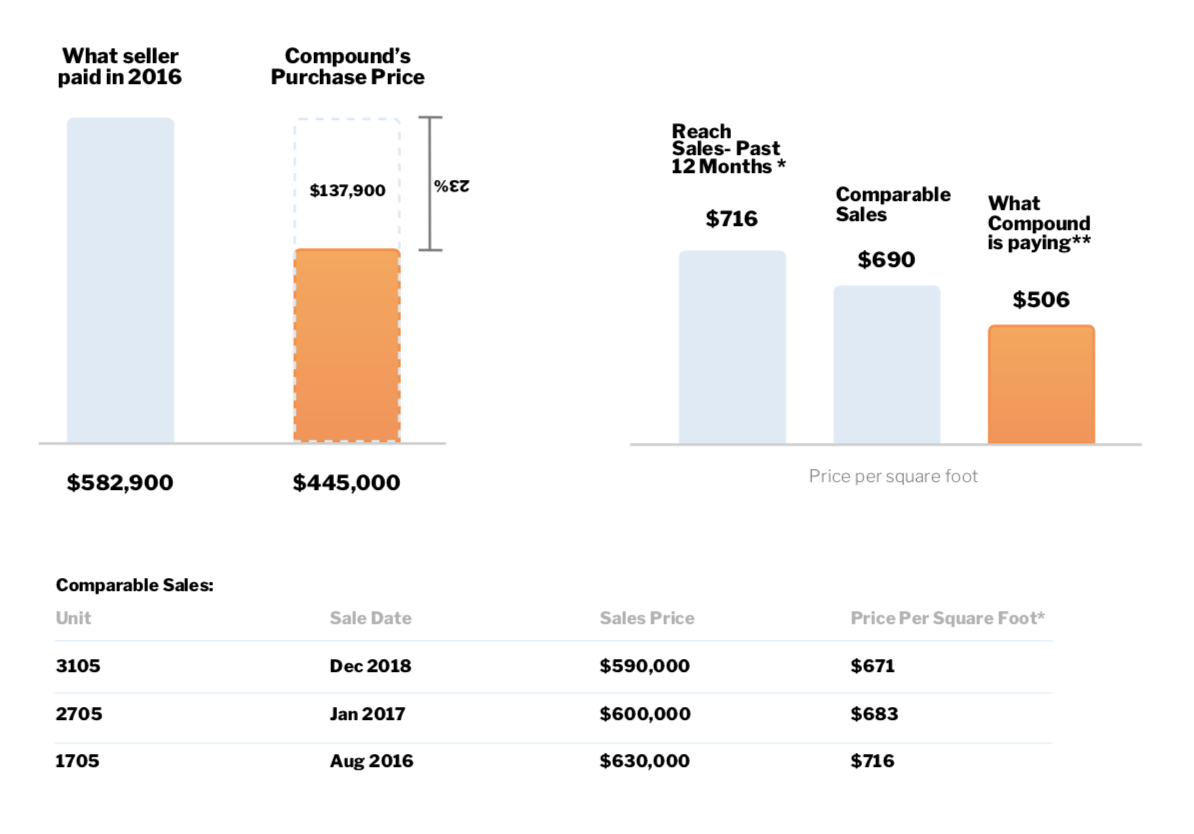

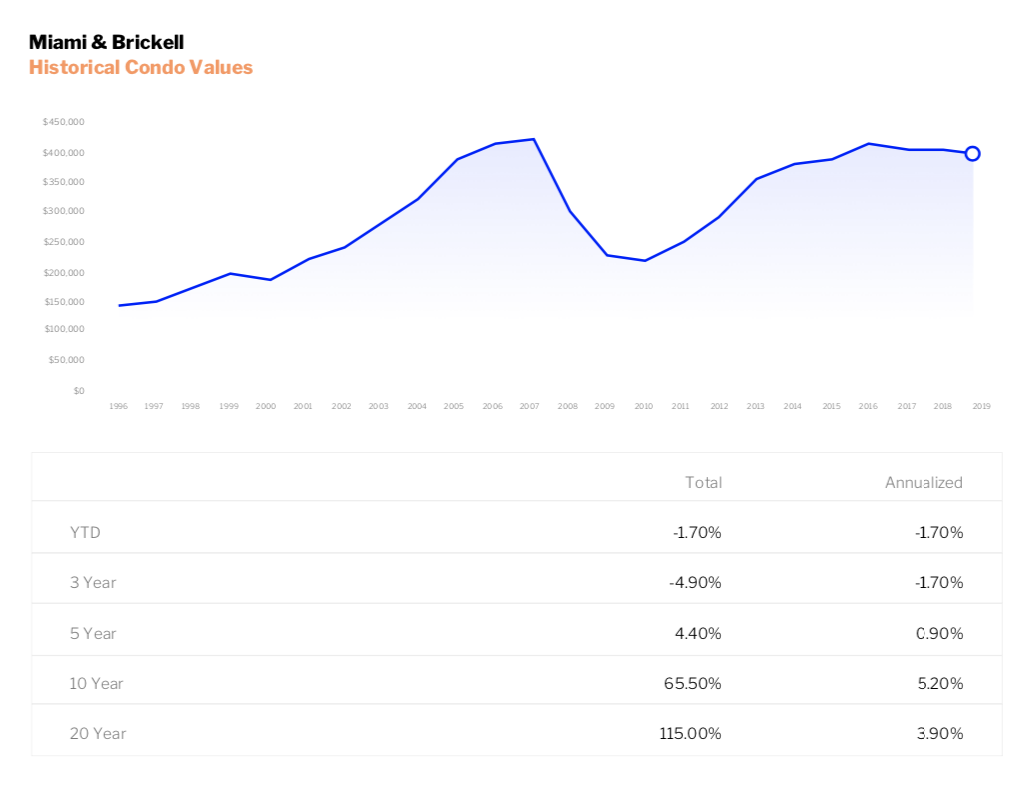

- Market Opportunity – Due to a weakness in the Miami condominium market, we are acquiring this property at a significant discount to historical sales.

- No Management Fees – Compound does not charge any asset management fees and we do not take a share of the profits.

- Investors in the campaign must be U.S. citizens with a valid U.S. bank account. All investors will be required to submit a W-9 before their investment is finalized.

The Opportunity

The Miami condominium market is experiencing a price correction after a 5-year construction boom, with lower prices, less sales volume, and greater discounts. As a result, Compound Projects has identified opportunities to acquire condominium units at compelling valuations.

The Miami condominium market is experiencing a price correction after a 5-year construction boom, with lower prices, less sales volume, and greater discounts. As a result, Compound Projects has identified opportunities to acquire condominium units at compelling valuations.

We are offering shares in a 1-bedroom, 1.5 bathroom condominium in the Reach at Brickell City Centre, a 43-story residential condominium building located in the heart of the Brickell neighborhood of Miami.

Financial Summary

Purchase Price: $445,000

Price/Sq. Ft: $506

Total Capitalization*: $480,000

* Includes closing costs and operating reserves.

What have other comparable units in the building sold for?

Other one-bedroom units in the same line in the same building have sold for $590,000 to $630,000.

* As of 10/11/2019, from Miami MLS

* As of 10/11/2019, from Miami MLS

** Does not include closing costs and reserves

What are the returns?

At Compound, we’re realists. That means we don’t make up numbers. What we do, put very simply, is find condominiums that we can buy at prices that make sense.

How do we determine if a purchase price makes sense? Well, first of all, we’ve done this before. Our team is made up of people who have a few decades of professional real estate experience (each!). Together, we take a hard look at supply (new units coming to market) and demand (new household formation and market occupancy). We look at what other similar units have sold for (comparable sales) and we look at current market conditions (average rents, market occupancy rates, and operating expenses.)

Then, we compare the price we believe the unit is worth against the asking price--and we negotiate to acquire a property at a price that we think is attractive from a value perspective.

What about traditional real estate metrics such as cap rate or cash on cash?

Condos do not sell on the basis of their ability to generate income. Instead, their value is largely based upon supply and demand. Think of condominiums more like a commodity--like oil or gold--that have both a real-world value and an economic value that makes them a store of wealth. When the market thinks they are rare, their value increases. Neither oil nor gold throws off any current income, and yet, they are very valuable assets to own.

What's the IRR?

Investors love to talk about IRR (or internal rate of return). But guess what? There are really only a few facts that can be known with certainty in real estate investment: where the property is located, how big it is, and what you pay for it. Everything else, from future rents to projected returns, are little more than fantasy--right up there with unicorns and UFOs.

And Now for the Truth (The Market is King)

You know how magicians swear never to reveal the secrets of their tricks? We’re about to become the rogue magician of the real estate investment industry.

That’s because you will have a hard time finding a real estate firm willing to admit that their ingenuity is actually a very tiny component of their success. Rather, real estate returns are mostly a matter of being in the right market at the right time.

The equities world has already faced this reality, which is why more capital is being passively managed than ever before. But in real estate, every investor is a self-proclaimed genius. (They are always the best managers who can find the best “off-market” details and blah blah blah.) We are happy to admit it: the markets we invest in will determine the majority of our returns. We will seek to buy at the best values possible in order to enhance those returns, but at the end of the day, you are investing in a market and, drum roll please, the market is king.

Property description

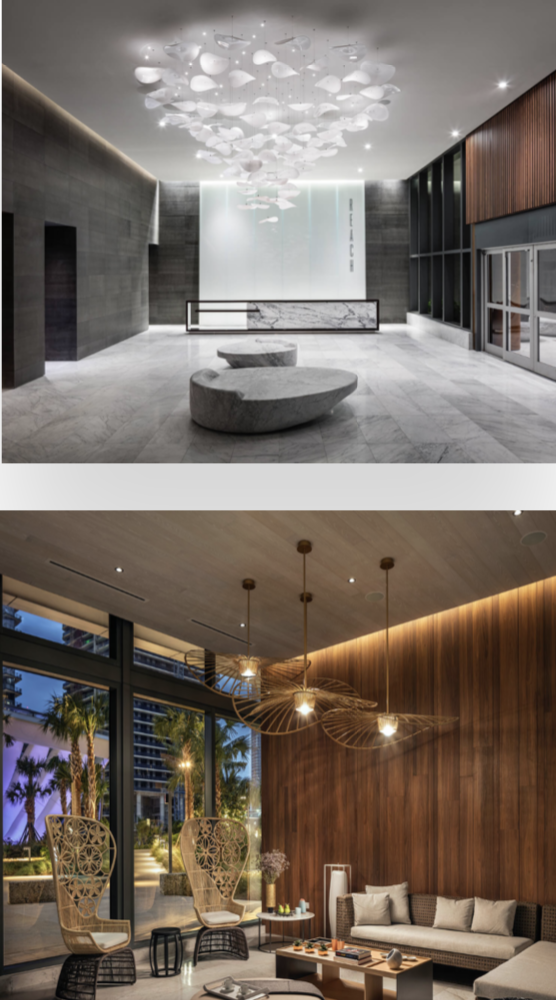

Reach at Brickell City Centre is a 43-story residential condominium building located in the heart of the Brickell neighborhood of Miami. The building, designed by Arquitectonica, and completed in 2016, sits in the middle of the Brickell City Centre development project. Brickell City Centre includes two residential towers, two-mid rise office buildings, the East Miami hotel, as well as a world class indoor shopping center with 109 retail stores and restaurants including Saks Fifth Avenue, Chanel, Chopard, and Emporio Armani.

Building amenities:

Building amenities:

Common deck with tropical gardens, outdoor fitness areas, children’s play area and barbecue grills

- Heated lap and social pools

- Library with private seating

- State-of-the-art fitness center with individual fitness studios and machine room

- Children's playroom

- Exclusive spa for residents' use with dipping pools, showers and steam treatment

- Business center with meeting room

- On-premise concierge

- Assigned parking for all units in secured garage plus optional valet parking service

What do we love about this property?

- Construction in Brickell has declined as most parcels have been developed

- The property is located at the center of Miami's business district, atop a luxury shopping destination, Brickell City Centre

- The unit has open city and water views from the 18th floor

- The property was built recently in 2016 and is in brand new shape

Look and location

The neighborhood

Brickell, also known as Miami's business district, is home to a large number of international banks such as HSBC, Espirito Santo Bank, and Banco Santander among other Fortune 500 companies. Brickell is considered to be one of South Florida’s most prestigious neighborhoods and is a favored place to live for young professionals.

At the heart of Brickell, located along South Miami Avenue, is Brickell City Centre. Brickell City Centre, a $1+ billion mixed-use development project developed by Swire Properties, spans over 9 acres and includes two residential towers (Reach and Rise), two office towers and a 5-star hotel (EAST Miami Hotel) all built atop a 500,000 square foot indoor shopping center.

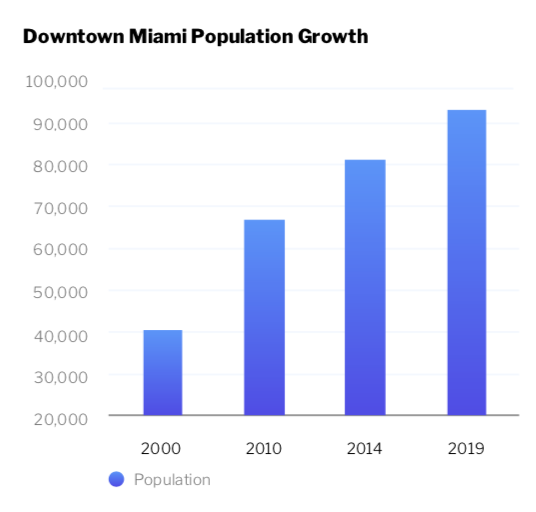

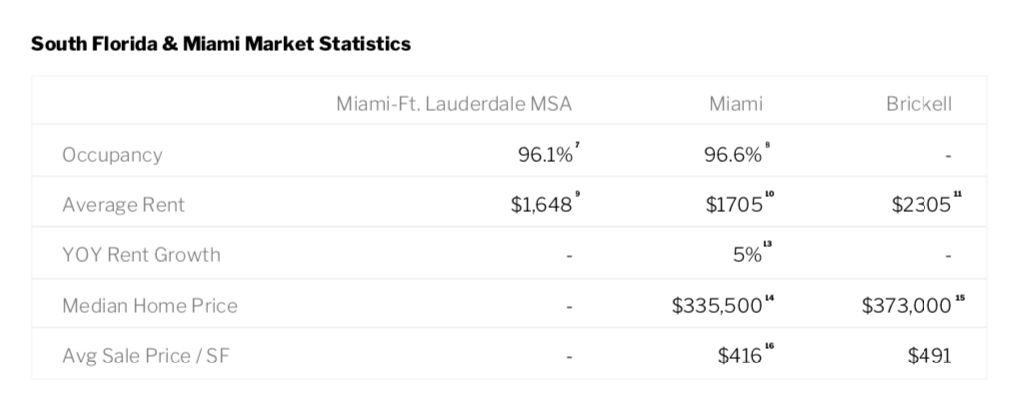

The Miami apartment market

- Growing population and jobs.

Population is growing by 2% annually, with more than 260 people moving to the region every day, supporting the creation of more than 111,000 jobs over the past year.

- Stabilizing apartment inventory.

More than 50,000 apartments have been constructed in South Florida since 2011, with another 10,800 units being built this year, according to a recent Marcus & Millichap report. Rental inventory grew by 4,800 units in Miami-Dade County, the highest amount in the region.

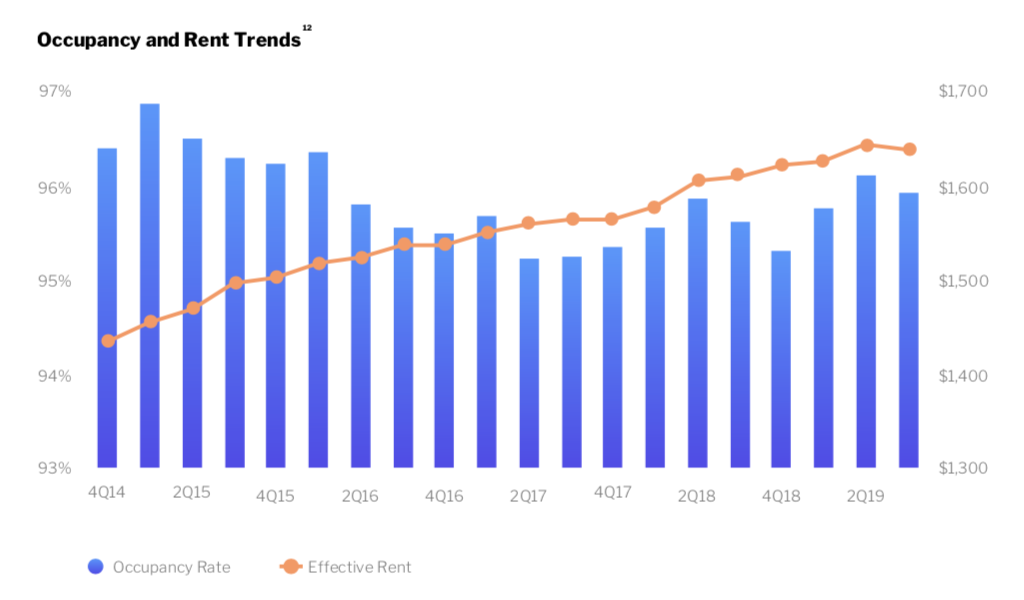

- Increasing occupancy.

Despite the new supply, annual apartment absorption surpassed inventory growth to elevate occupancy. Year over year, apartment occupancy in downtown Miami and South Beach has increased from 95.4% in 3Q 2018 to 96.6% in 3Q 2019.

- Rising rents.

Rents are starting to rise in Miami after a flood of inventory from new apartments and condos that are now being rented out and apartments are being absorbed.

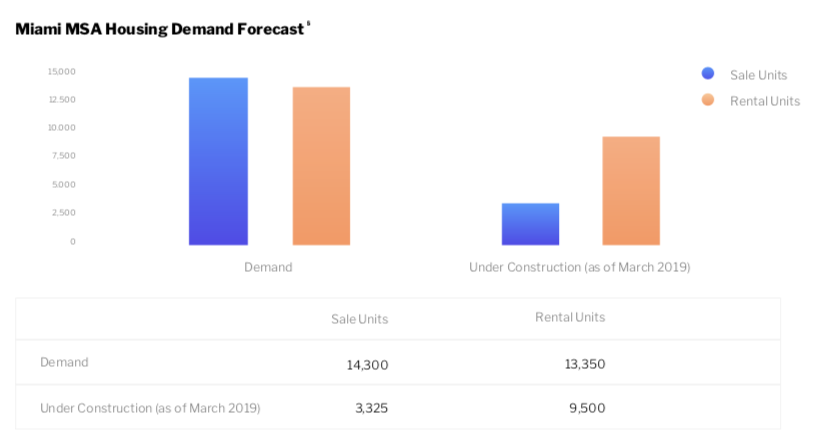

- Future demand exceeds supply. During the 3-year forecast period, demand is expected for 13,550 additional rental units. The 9,500 units currently under construction are expected to meet demand during the first and second year of the forecast.

Source: Comprehensive Housing Market Analysis: Miami-Miami Beach-Kendall, Florida U.S. Department of Housing and Urban Development, Office of Policy Development and Research As of March 1, 2019

Source: Comprehensive Housing Market Analysis: Miami-Miami Beach-Kendall, Florida U.S. Department of Housing and Urban Development, Office of Policy Development and Research As of March 1, 2019