- Own a piece of Miami real estate, no matter where you live in the US

- Miami Cityfund has already invested in multiple properties within Miami

- Focused exclusively on single-family residential real estate in Miami

- Miami home prices appreciated over 59% in the last 3 years (Zillow HVI)*

- Gain exposure to an asset class that's difficult to participate in

- Managed by industry veterans with 20+ years of experience

Overview

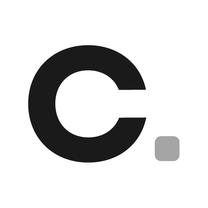

1 Zillow Group, Inc., 2022 U.S. Housing Market has Doubled in Value

2 Federal Reserve Board Financial Accounts of the United States, as of Q2, 2022.

Cityfunds

A city-specific real estate portfolio

Built for the next generation of investors.

By investing in fractions of homeowner equity in top cities, Cityfunds has made it possible for everyone to own real estate in top markets like Austin, Dallas, Miami, and Tampa.

Please review important disclosures at the bottom of the section

Please review important disclosures at the bottom of the section

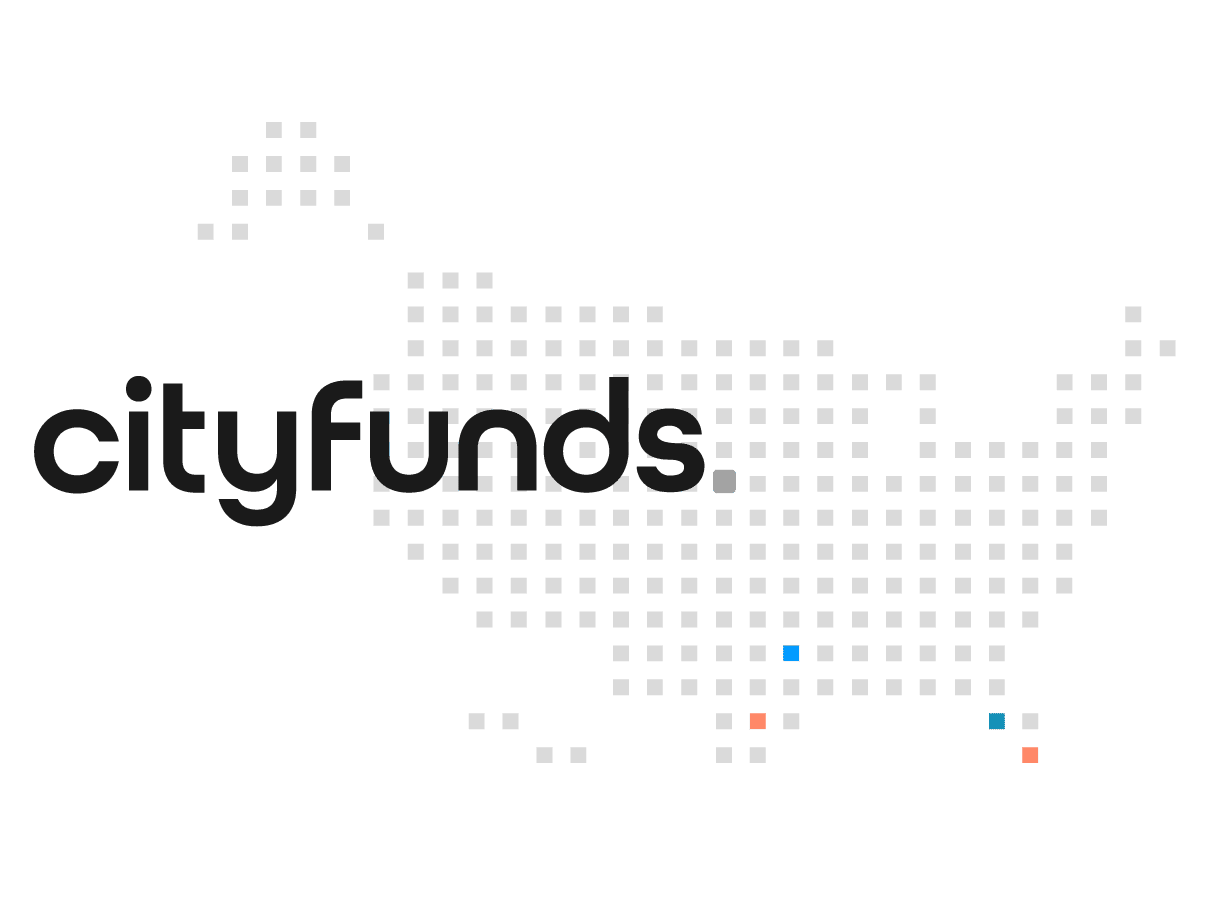

What is a Cityfund?

A Cityfund is similar to an index fund (but not actually an index fund) in that it provides targeted exposure to residential real estate in a single city. We're unlocking access to markets typically inaccessible to investors.

Product Design

Cityfunds were designed from the successful transformation we have seen from actively managed mutual funds to passively managed index-based ETFs.…

Miami

Miami. The city, synonymous with its vibrancy and nightlife, is also well on its way to becoming one of the largest international hubs in the world. From surf, sand, and sun to a booming tech industry in an established financial and commerce center, the “Magic City” is a fitting nickname. Major business clusters in the Miami - Ft Lauderdale - West Palm Beach area include financial services, information technology, tourism and transportation, international trade, and media.

One of the hottest cities to move to during the pandemic, Miami’s real estate market is still hot and in demand. The party doesn’t stop here in the cruise capital of the world (according to Miami Dade County), and neither does the increase in home values. With no…

Strategy

Home Equity Investments ("Homeshares")

A Homeshare is an investment into single-family home equity whereby the Cityfund provides an upfront payment in exchange for a share of the home’s future appreciated value, representing fractional ownership.

Product

The Homeshares product solves a two-sided problem within the residential real estate market:

- Homeshares unlock a portion of the $27T home equity market for investors seeking access to high-demand & supply-constrained markets.

- Homeshares enable liquidity and diversification for homeowners without incurring new debt or moving out of their home.

Acquisition

Nada’s Homeshares are investments into home equity, whereby the Cityfund provides an upfront payment to a homeowner.

Management

The managing member of the Austin Cityfund is Cityfund Manager, LLC, sponsored by Nada Asset Management.

Terms

Offering

Offering up to 700,000 Interests at $10.00 per Interest.

Management Fees

The manager will receive the following fees:

- Management Fee: 1.5% per annum of the equity value per Cityfund.

- Acquisition Fee: 1.0% of the gross purchase price of each SFR.

Secondary Trading*

We intend to enable secondary trading to enable the selling of shares.

We expect that after an Austin Cityfund primary market offering period has concluded, the Public Private Execution Network Alternative Trading System, or "PPEX ATS," which is registered with the SEC and operated by North Capital Private Securities Corp., will be a venue available for the resale of such shares through Dalmore, as a broker-dealer member of the secondary trading.

Returns

Cityfunds are designed to provide returns that are related to the home-price appreciation of a specific market. While we are focused on sourcing acquisitions that have the potential for capital appreciation, the market will ultimately determine returns.

Disclaimers

Risks of early stage investment. Not an offer to buy or sell securities. This is a long-term speculative illiquid investment. Investment is not FDIC or SiPC insured. You may lose money.

Past performance does not predict future results.

Your investment is binding and irrevocable, although we reserve the right to reject it for any reason or no reason at all. Funds committed will remain in an escrow account maintained by BankProv until such time as a closing occurs. Securities offered through OpenDeal Broker LLC, a registered broker dealer, member of FINRA (www.finra.org), member of SIPC (www.sipc.org). We will pay OpenDeal Broker LLC, a registered broker-dealer, a cash commission equal to 4% of the value of the series interests sold through…