Highlights

- Own a piece of the Austin real estate market, no matter where you live

- Focused exclusively on single-family residential real estate in Austin

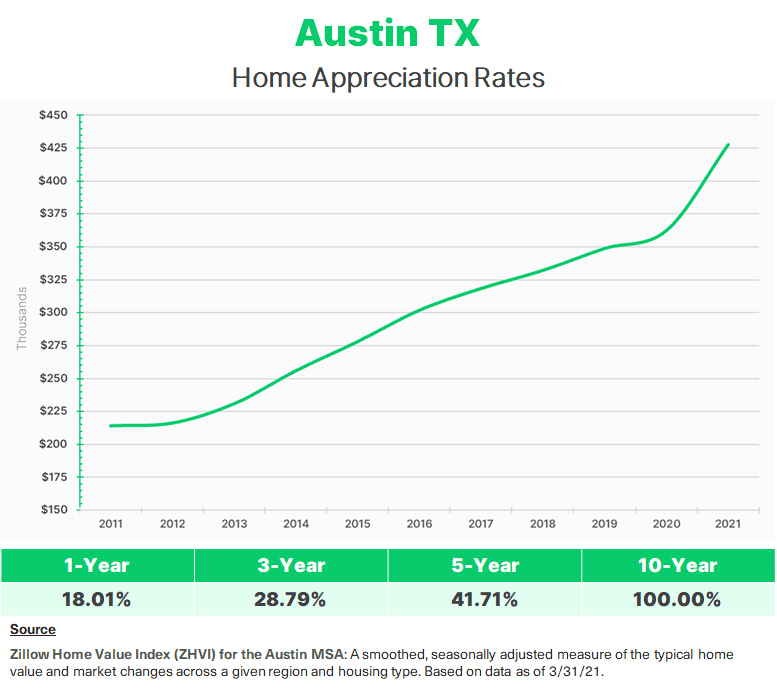

- Home prices have increased over 18% in the last year (Zillow)*

- And have appreciated 100% over the last 10 years (Zillow)*

- Strategy to acquire residential units in core markets in Austin

- Gain exposure to an asset class that's difficult to participate in

- Managed by industry veterans with over 30 years of experience

The maximum investment available in this offering is $5,000. If you are an accredited investor who would like to invest at least $10,000,

Overview

The Austin Cityfund will acquire and manage a portfolio of single-family residential real estate assets in Austin only. Our acquisition strategy will focus on (1) investing in the equity of owner-occupied single-family homes ("Homeshares") and (2) purchasing single-family rentals that we believe offer compelling values with the potential for significant appreciation while providing investors unprecedented access to the highest-demand, fastest-moving real estate markets, like Austin, Dallas, and Miami.

Cityfunds

A new real estate investment product, from Republic Real Estate \

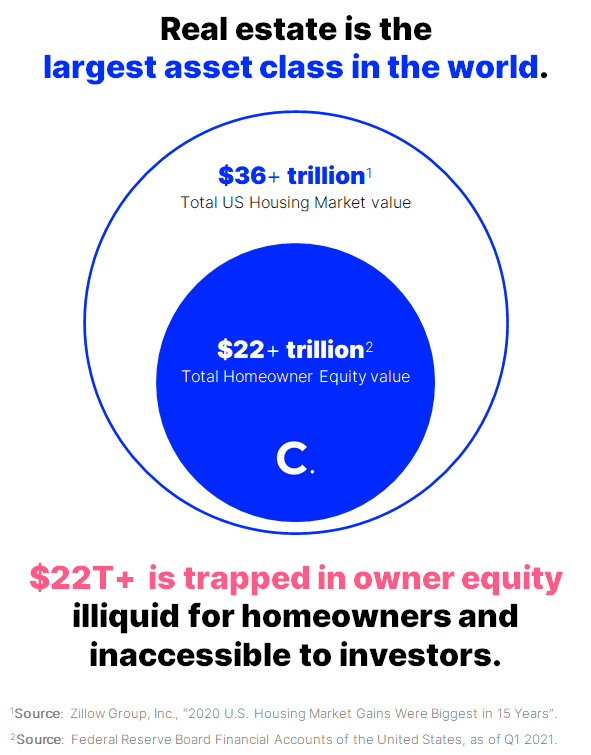

What is a Cityfund?

A Cityfund is similar to an index fund in that it provides targeted exposure to residential real estate in a single city. Providing access to high-demand, fast-moving markets typically inaccessible to most investors. Cityfunds are designed to mimic the performance of residential real estate in one city only.

What makes Cityfunds different?

Why did we create Cityfunds?

We designed the Cityfund based on the transformation we have seen in the equities market from actively managed mutual funds to index-based exchange-traded funds (ETFs). Many ETFs enable investors to make very targeted investment decisions within a specific sector, geography, or risk…

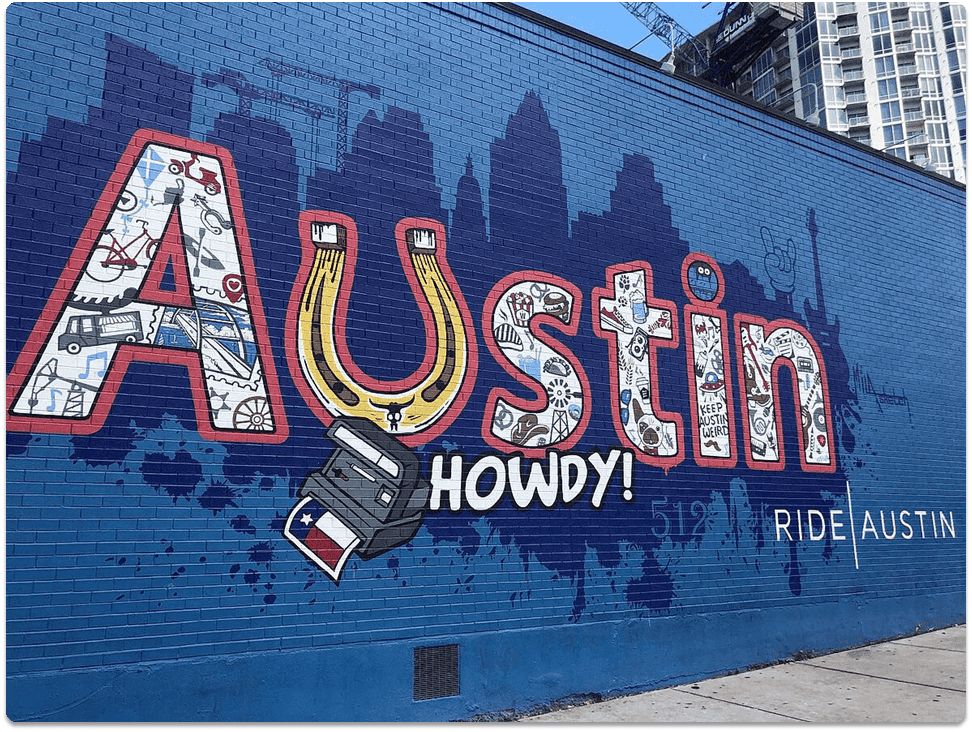

Austin

The Austin housing market saw incredible demand in 2020 despite the COVID 19 pandemic, and this momentum has continued into 2021. Demand has consistently outpaced supply, which is causing Austin home prices to soar.

As technology companies such as Tesla, Apple, and Oracle continue to migrate to Austin, home sales and prices in the Austin real estate market continue to soar. In fact, Austin ranked number 3 on Zillow's list of top metros for inbound moves in 2020.

After outpacing all other large markets at the end of 2020, Austin’s housing market is again anticipated to be the nation’s best performing in 2021. The Q4 2020 Zillow Home Price Expectations Survey notes that Austin is expected to outperform the national market by…

Strategy

Acquisition

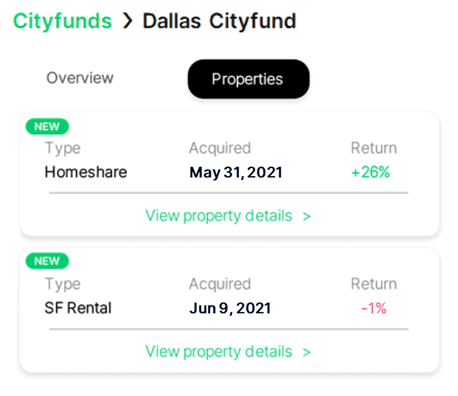

Nada’s Homeshares are investments into owner-occupied homes, whereby the Cityfund provides an upfront payment to a homeowner in exchange for a lien-secured share of the home’s future appreciated value. Homeshare investments are made directly by Nada and sourced through their network of licensed real estate agents and direct-to-consumer marketing channels.

Nada has established consumer and property qualification standards; in addition, each Homeshare investment is placed at a risk-adjusted discount to market value—offsetting the risk of declines in home values and protecting the initial investment.

Management

Homeshare investments ensure the owner retains ownership rights and responsibilities. Each Homeshare investment is recorded…

What is a Homeshare?

A Homeshare is an investment into owner-occupied single-family homes whereby the Cityfund provides an upfront payment in exchange for a share of the home’s future appreciated value, representing fractional ownership.

Why invest in Homeshares?

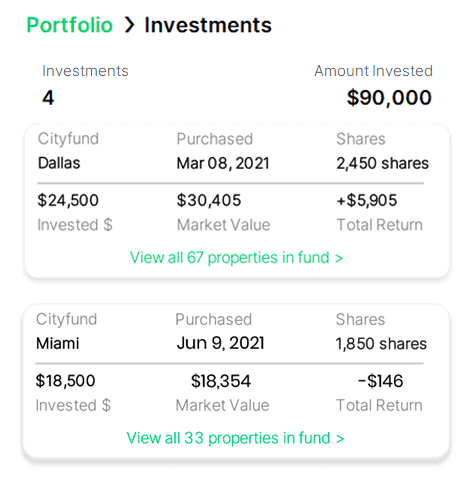

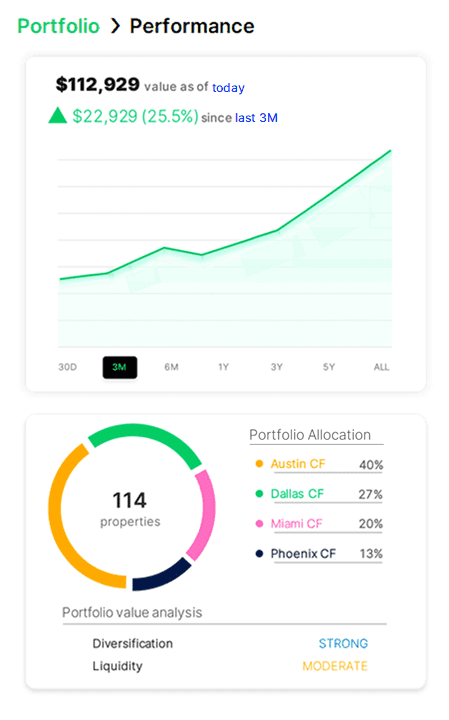

1) Automated log of your Cityfund investments (hypothetical)

2) Real-time notifications of new acquisitions (hypothetical)

3) Personal portfolio & performance tracker (hypothetical)

4) Monitor Portfolio-level performance--down to the property-level (…

Management

The managing member of the Austin Cityfund is Cityfund Manager, LLC, sponsored by Nada Asset Management and Republic Real Estate.

Republic Real Estate is the tech-enabled real estate investment vertical of Republic led by Jesse Stein who has 20+ years of industry experience and has been involved in multiple real estate public offerings and over $1 billion of real estate transactions.

Terms

Offering

We are currently offering up to 50,000 Interests at $10.00 per Interest through this offering. The minimum investment is $500 and the maximum investment is $5,000.

The maximum investment available in this offering is $5,000. If you are an accredited investor who would like to invest at least $10,000,

Management Fees

Cityfund Manager, LLC will receive the following fees for services related to the investment and management of the Portfolio's assets:

Asset Management Fee: 1.5% per annum of the aggregate capital contributions to the Cityfund.

Acquisition Fee: 1.0% of the gross purchase price of each single-family property we acquire.

Leverage

We may employ modest leverage on our single-family acquisitions to…

Returns

Cityfunds are designed to provide returns that are related to the home-price appreciation of a specific market. While we are focused on sourcing acquisitions that have the potential for capital appreciation, the market will ultimately determine returns. We cannot assure you that we will attain this objective or that the value of our properties and your investment will not decrease.

Market Data*

Based on recent historical and assumed continuing home-price appreciation, we expect both our single-family rental acquisitions as well as our Homeshare investments to generate annual internal rates of return ("IRR") of between 12% and 15% over a 7-year period. These estimated returns may not be met.

We have provided examples below for…

Disclaimer

* Past performance is not indicative of future results. No assurance can be provided that the market or the value of our investments will appreciate or will not depreciate in value.